Here is the translation of the provided text into English: Trouble seems to be brewing again as the U.S. is sweeping across the globe, and India is on the verge of collapse.

Currently, Wall Street consortiums are shorting the Indian stock market, and it's uncertain whether India will continue to support the U.S. Amidst the global economic landscape, how long can the U.S. dollar's dominance sustain?

Just a couple of days ago, I mentioned that due to the strong U.S. dollar index, the Japanese yen, South Korean won, and Vietnamese dong have all depreciated to new heights, prompting countries to wage currency defense wars.

Now, India's troubles have arrived as well.

That is, the Indian rupee has recently fallen below 83 against the U.S. dollar, also setting a historical low!

Moreover, it is speculated that the rupee's downward trend will continue.

However, the crux of India's problem lies elsewhere.

The most critical issue is that Wall Street consortiums are currently shorting the Indian stock market, aiming to reap the Indian economy entirely!

Currently, global funds' net short positions on Indian stock index futures have soared to 213,200 contracts, reaching a 12-year high!

So, what is a net short position?

It is the excess of contracts sold over those bought for the asset at the current point in time.

It can be said that foreign investors' view of the Indian stock market has fallen to the most pessimistic level in over a decade.

Isn't the Indian economy robust?

Didn't India's GDP grow by 7.8% in 2023?

So why are global investors bearish on the Indian economy now?

There are two reasons: one is concern over India's domestic economy, and the other is the rise of China's economy.

Although India's GDP grew by 7.8% last year, its inflation rate is not low either.

According to India's statistical data in April, the inflation rate has reached 6.95%, setting a new high for 17 consecutive months.

It seems that India's high economic growth is built on high inflation, which is a sign of inflated performance!

Secondly, although the Indian stock market has been setting new highs in recent years, behind the scenes, out of the 183 companies that went public in India since 2021, 44 currently have stock prices below their issue prices.

It is worth mentioning that in 2023 alone, the number of stocks listed in India exceeded that of China's A-share and Hong Kong markets.

It seems that even a shell company can go public in the Indian stock market.

It can be said that retail investors have been severely "harvested" by the Indian stock market!

As of early April this year, foreign investors withdrew about $4 billion of funds due to the inflated Indian stock market!

In summary, both the Indian economy and the stock market are currently facing significant bubbles.

This phenomenon is precisely the result of Modi's grand promises to replace China as the new world factory and to use massive fiscal spending to promote infrastructure construction.

However, the attitude of "India earns, India spends" towards foreign capital, coupled with the low work efficiency of Indian workers, and the reliance on China's industrial chain, it can be said that Modi's dream is beautiful, but the reality is harsh.

Now, global investors have seen through Modi's tactics, that is, the Indian economy is likely to be a "Dou" that cannot be supported!

Moreover, Modi has been cooperating with the U.S. "Indo-Pacific Strategy" and constantly provoking China.

In this round of Sino-American competition, China's economy can be said to be as stable as a rock, and it is even rising rapidly.

On the contrary, due to the U.S. economic crisis and the U.S. dollar's bottomless harvesting, some of the U.S. allies and little brothers such as France, Germany, and South Korea are now leaning towards China.

Modi has always been sitting on two boats, and now Modi's pro-American attitude has made global investors see the crisis in India.

It can be said that the Indian economy is globally, "blowing hot air with a loose hand, and rolling eyes with a tight grip."

So, under Modi's current economic strategy, it is natural for global investors to be bearish on the Indian economy.

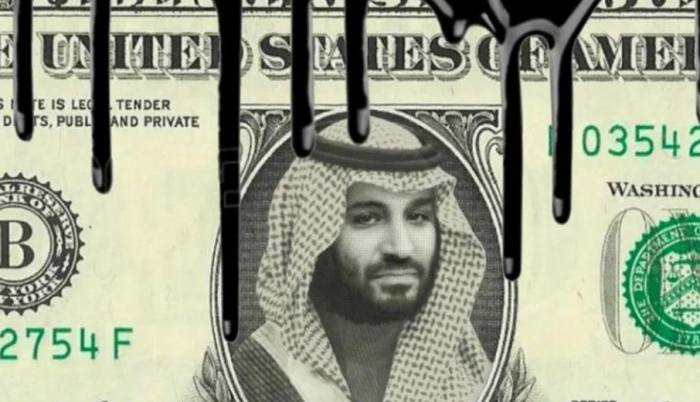

Finally, let's talk about how long the U.S. dollar's dominance can sustain with such bottomless harvesting.

In fact, in this round of Sino-American competition, the U.S. harvesting Japan, South Korea, Vietnam, and India is also incidental.

In other words, even if Japan, South Korea, and India's dependence on the U.S. economy decreases, it will not affect the global hegemonic status of the U.S. dollar.

Because we must understand that the U.S. dollar can dominate globally because previously, Middle Eastern countries and Russia could provide the world's core resources for it, and China is the world's largest manufacturing country, which can continuously supply goods to the world, and the U.S. itself is the world's largest financial country.

The U.S. prints dollars to buy goods worldwide, and countries around the world will buy oil from the Middle East and Russia after getting dollars, and after the Middle East and Russia get dollars, they will deposit them in the Federal Reserve to buy U.S. Treasury bonds.

It can be said that over the past few decades, under this economic order, everyone has been living in peace, and the dollar system can create a financial closed loop, continuously harvesting the wealth of other countries.

But now the U.S. is harvesting the world without bottom, offending several very important countries.

Russia has left the dollar system, and Middle Eastern countries are getting farther away from the U.S. due to the Israeli-Palestinian conflict.

As for China, the U.S. is trying to decouple and break the chain, now it wants to have China's high-quality and low-priced goods, and it is trying to limit China's development.

The key is that the U.S. has also offended the whole world, and now even its own little brothers are rebelling.

Let's not talk about what the U.S. economy will be like next?

Let's talk about what the dollar will be left with after losing the two core elements of maintaining global hegemony, energy and goods?

Some industry insiders have said that the dollar will eventually become a second-tier currency, that is, a regional currency.

So, under the U.S.'s bottomless harvesting, will India finally also lean towards China's arms like Germany, France, and South Korea?

Join the Discussion