Here's the translation of the provided text into English: The trouble is escalating, with the Federal Reserve caught in a dilemma, and expectations for a US dollar rate cut are changing again.

Where will the US economy ultimately head?

What does this mean for China's economy?

Just two days ago, after Sweden, Switzerland, Canada, and Europe announced rate cuts, it started to pressure the Federal Reserve to cut rates as well.

Some might argue, won't rate cuts in other countries lead to a dollar repatriation?

How is this different from the US dollar increasing interest rates to reap wealth from other nations?

Why would it pressure the Federal Reserve to cut rates?

Let me first discuss the complexity of international economics.

It can be said that in different periods, even with the same monetary policy, completely opposite outcomes can occur.

For example, when the entire market economy is in a state of hot money, rate cuts in other countries allow various capitals to withdraw funds and deposit them into US banks, or invest in US Treasury bonds, both of which can yield substantial returns.

However, when the entire market economy is in a recession, the withdrawn funds face the risk of defaults when buying bank financial products, and buying US Treasury bonds may face the embarrassment of no one to take over.

At this time, even if the US dollar raises interest rates again, or other countries cut rates again, the repatriation effect will not be very obvious.

This means that if the US economy shows a clear recession, even if the US dollar interest rate increase is sky-high, the repatriation effect will be limited.

Because at this time, everyone is afraid to invest.

It's like when a person is heavily in debt and completely discredited, and then promises you a higher return, you dare not buy it.

Therefore, this is the reason why gold keeps setting new highs.

As the risk of US Treasury defaults intensifies, everyone starts to avoid the storm.

Let's talk about why the rate cuts in various countries are pressuring the Federal Reserve to cut rates.

It can be said that under the current market conditions, the US dollar index is strong, and most of the countries that dare to cut rates before the US dollar are developed countries.

Because the effect of dollar repatriation caused by developed countries' rate cuts will be even less obvious.

Moreover, the economic foundation of developed countries is strong, and even if their own currency raises interest rates, it will not lead to a currency collapse.

Just like Europe, after the euro rate cut, the euro's exchange rate against the US dollar is still rising.

At this time, the rate cuts in other countries will produce different results, that is, the effect of stimulating the domestic economy will be far greater than the damage caused by dollar repatriation.

This is the fundamental reason for the rate cuts in the aforementioned countries.

That is, the domestic economic growth is weak, and inflation is also suppressed almost enough, at least much better than the United States, it's time to cut rates.

Secondly, this will also make the US goods imported by the country more expensive.

At this time, if the US dollar does not follow the rate cut, then the people of the countries that cut rates will look for substitutes for American goods, which will suppress the development of American enterprises while promoting the growth of domestic enterprises.

This is another fatal blow to the current economic development of the United States.

So the question is, as countries start to force the dollar to cut rates, will the dollar really cut rates?

Let's first look at a set of data: In May, the number of new non-agricultural jobs in the United States was 272,000 people, exceeding the expectation of 180,000 people by economists.

This provides a strong basis for the US dollar not to cut rates.

At this time, some people will say, isn't the unemployment rate in the United States rising in May?

But we must understand that the statistical caliber of these two is different.

Moreover, the unemployment rate is rising because more people are leaving the labor market, leading to a decline in the labor market participation rate, which does not mean that the US job market is weak.

In this regard, Citigroup has postponed the expectation of the US dollar rate cut from July to September.

JPMorgan Chase has even postponed the timetable for the US dollar rate cut to November.

However, there are also institutions that believe that the US job market is far from as strong as everyone thinks.

That's because half of the data comes from illegal immigrants.

According to data from the US Immigration Bureau, millions of illegal immigrants were employed in the past year.

If these numbers are removed, the monthly new non-agricultural employment in the United States in the 24th fiscal year is about 125,000 people.

If we look at this data, the US dollar rate cut is imminent.

Speaking of this, I don't know whether the current data in the United States is true or false?

Who is this data made for?

Even if we set aside these factors, now more and more developed countries have started to cut rates one after another.

If the US dollar does not cut rates, it means that the US economy will confront more developed countries.

Now the scale of US debt has reached a new high, and American companies are suffering.

The economic game between China and the United States is getting more and more intense.

How long can the United States persist?

I'm afraid only the United States knows.

In other words, it's not that the United States dare not cut rates, but that the United States does not want to cut rates at all.

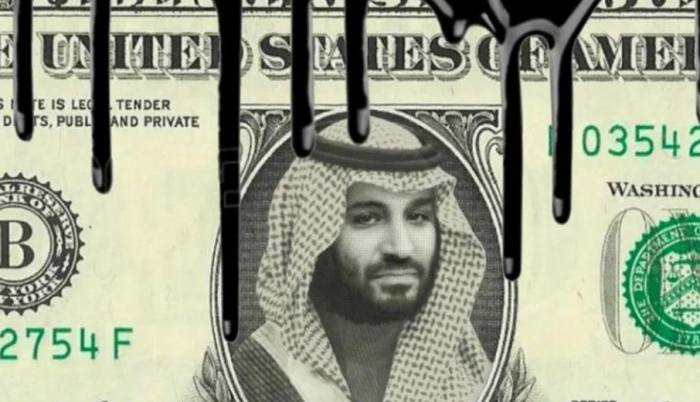

Because in this round of the US dollar interest rate cycle, which country does the United States want to empty the most?

Of course, it's China.

But now China's economy is as stable as a rock.

If the United States chooses to cut rates easily, it means that the US harvesting plan has completely failed, and the game between China and the United States is over.

Will the United States be willing?

Therefore, as countries start to cut rates one after another, this will only further stimulate the United States' overreaction.

So before the US dollar really cuts rates, the United States will definitely make some moves until it is out of ammunition, and then the United States will choose to passively cut rates and admit defeat.

Everyone has time to pay attention to the latest developments between Russia and Ukraine, and the United States has upgraded this matter.

It can be said that the United States is really impatient now.

Finally, let's talk about what it means for China's economy when Western countries start to cut rates one after another?

Now the euro is the second largest trading currency in the world.

If the euro cuts rates, it will increase the liquidity of the European market, thereby increasing the demand for global goods.

This is definitely a good thing for China's commodity exports.

In addition, with the implementation of the euro's monetary easing policy, it will also strengthen the investment strength of foreign capital in China, which is also a major benefit for China's business environment.

It can be said that in the current global economic downturn, Western developed countries are the first to start the wave of rate cuts, which is a major benefit for global economic development, but only detrimental to the US economy.

Because only the United States is thinking about how to harvest the world's leeks.

If Europe cuts rates, it's a stab in the back to the United States, which is still light.

In my words, Europe wants the United States to show its true colors, stop struggling to the death, and end the game between China and the United States as soon as possible.

Only then will the world's good days truly begin.

Join the Discussion